Sometimes as a financial planner I offer to meet with my client’s child or grandchild. If they are just beginning, I usually like to talk to them about budgeting and long term vision of creating a written financial plan. It always amazes me how ill-equipped parents are in educating their kids about basic budgeting. It was during one of these meetings that I was asked about mobile budgeting. Turns out I was the one ill-equipped. I hadn’t a clue so I decided I better start to research the best mobile applications for personal budgeting. This article is the result of what I found in the realm of personal budgeting apps. I list a few of the free, and simple, budget tools available to get you started.

As I mention in another article about personal finance budgeting, it is important to track your expenses not just for the obvious purpose of knowing what you spend, but to improve upon your prosperity consciousness. It is a funny thing when we track both our income and expenses. We tend to automatically ‘see’ a bit clearer and ask questions about our spending. Maybe you don’t need that extra set of pillows in off lime green after all?

I admit that although I am computer savy, a bit of a financial geek actually, I don’t use mobile budgeting apps. I love technology. But I still do budgeting with pen and paper and in excel. (see the excel version of a budget template I created) There is something magical about putting your thoughts on paper with a pen. We need a break from our computers, after all.

But that is not the trend. A recent Standard life survey found that 29% of respondents use a pen and paper to conduct their budgeting. This only shows that we are somehow slower to adapt to online budget applications than other technology.

Ok, I did a review and here is my short list of mobile budget applications. These mobile budget applications keep track of your expenses, and some even remind you to pay them online. These are great tools to track your income and expenses, and stick to a budget.

Oh. And these apps are free apps. See, you have no excuse to get going with tracking your expenses and creating a budget.

My Short List of (Free) Personal Mobile Budgeting Apps

The list below are free mobile apps for expense tracking and budgeting. These great tools are easy to use, and can track everything you spend and also itemize expenses. It is entry level organization to track everything you spend. Tracking all your spending is the first step to knowing what you spend, reduce unnecessary spending, and well… save more for your future self.

Wally

Wally is available for iOS and has an Android version being tested. This highly intuitive application has an InstaScan feature that not only scans your receipt but both captures the relevant figures and categorizes them. As an extra feature, this mobile budget app has a GPS feature to show you where you mostly spend your money. Download

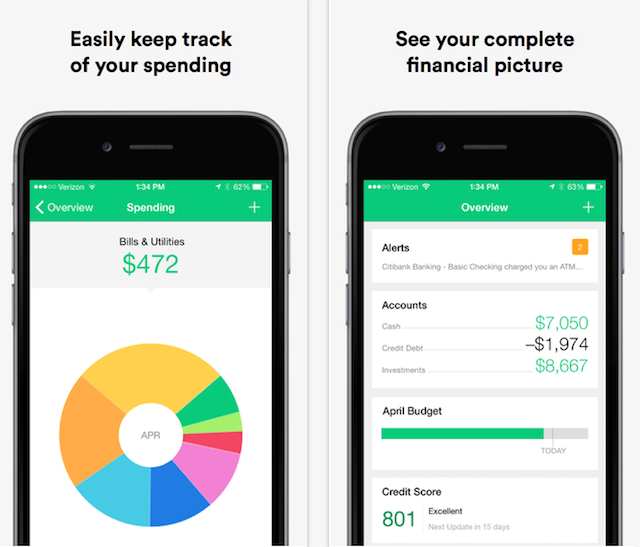

Mint for Canada

Mint is a free application created by the makers of Intuit (QuickBooks, Quicken) and promises to help you manage your money and spend smarter. Mint at first glance is intuitive and allows you to link to your banking, and will provide you with due date alerts and categorize your spending. With 128-bit encryption, it is probably secure enough to ease most minds. But I am not certain if using the application would void any cardholder agreements in terms of security guarantees. Download

Manulife Bank

Designed for iPad and iPhone only, this mobile application will intuitively track your expenses and help you identify budget deficits and savings potential. It will track income and expenses and print a personalized comparison chart to identify budget surplus or shortfall. Download

Standard Life

Available on iTunes, the Standard Life application will help you track your income and expenses. Download

Bottom Line for Mobile Apps and Your Personal Budgeting

If you are reading this and have kids or grandkids, consider having a discussion with them about the mobile applications listed above for your personal budgeting needs. If you happen to be one of those kids or grandchildren, then teach your parents! This is a teaching opportunity. The rewards are that you will learn about your spending and find saving opportunities. This will improve your bottom line for today and your future. Get going and track your budget!

Have you discovered a favorite mobile application for budgeting? Let me know which application worked for you and why.

![]() Book Your No Obligation Financial and Portfolio Review

Book Your No Obligation Financial and Portfolio Review![]()

Joanne David BA CFP FCSI

Joanne David BA CFP FCSI

Joanne David CFP FCSI

Joanne David CFP FCSI